The shareholders of U.S. Oil Sands, the Canadian company exploring and developing an open-pit mine in the Book Cliffs about 70 miles northeast of Moab, have agreed to allow the company to withdraw from the Toronto Stock Exchange.

Dropping out of the exchange was a condition of the company’s largest shareholder, ACMO S.à R.L., which is lending U.S. Oil Sands $5 million for capital to continue its operation at PR Spring, near the border of Uintah and Grand counties.

U.S. Oil Sands also announced in a news release that it has decreased its number of board of directors from five to three.

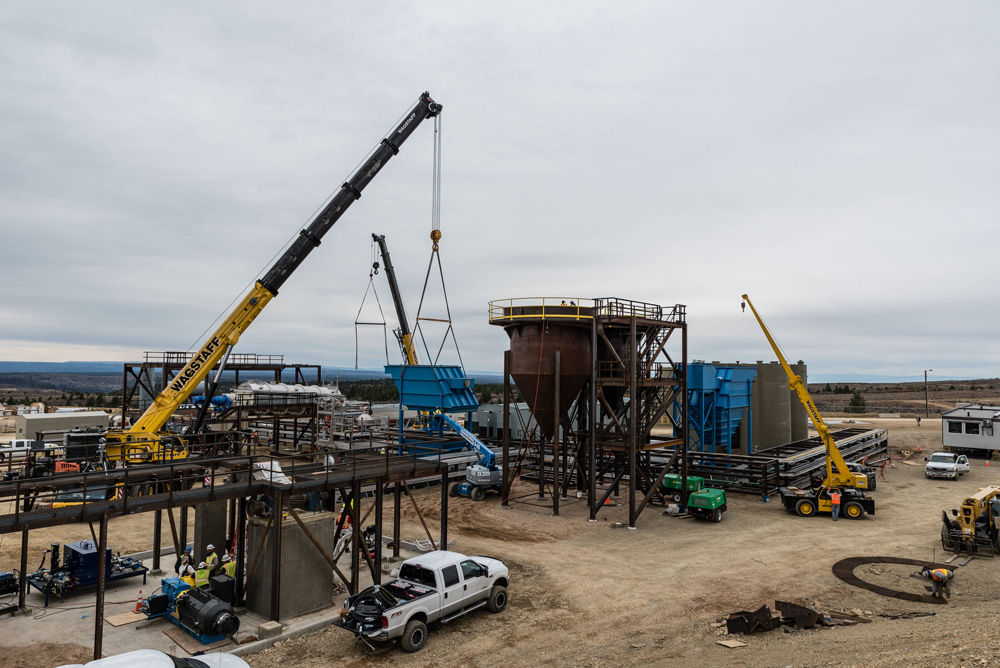

The Calgary, Alberta-based company is leasing 32,005 acres of Utah School and Institutional Trust Lands Administration (SITLA) property in Utah’s Uintah Basin, where it has been working on developing the oil sands using a proprietary extraction process that uses a bio-solvent derived from citrus. The technique allows for the extraction of bitumen from oil sands without the need for tailings ponds. The project is the first of its kind in the United States.

Bitumen is a black viscous mixture of hydrocarbons that is used for road surfacing and roofing. Most of the bitumen extracted from Canada’s oil sands is upgraded into synthetic crude oil and sent to refineries for conversion into a range of petroleum products, such as gasoline.

U.S. Oil Sands CEO Cameron Todd said the company has had to raise capital at various times over the years to continue its operations because the project is not yet generating revenue. The company started a pilot project at the site in 2005. The Utah Division of Oil, Gas and Mining issued a permit to U.S. Oil Sands in 2010, to develop the mine. Projected commercial mining start dates have been postponed several times. The current project “is another step in the overall process of commercial development demonstration,” Todd said.

Many of the nation’s oil sands deposits are located in eastern Utah’s Uintah Basin. The oil sands were formed 45 million years ago when organic deposits of driftwood, leaves, algae and animals settled to the bottom of a giant inland lake and were buried by sand and silt.

The strip mining of oil sands at PR Spring has long been controversial with some Utah residents. Members of the Utah Tar Sands Resistance, which was formed five years ago in response to the project, have held ongoing protest vigils near the mine for the past three years.

Living Rivers Conservation Director and Colorado Riverkeeper John Weisheit has long been concerned about the project’s water usage. U.S. Oil Sands drilled three dry wells before the company was able to locate water.

Weisheit contends that there’s not enough groundwater at the site and he’s concerned that the company could turn to the Green and/or Colorado rivers to acquire additional water for the project.

Weisheit said he suspects insufficient water is the reason the company has decreased its projected daily production of 2,000 barrels of bitumen to 500 barrels.

Water quality monitoring wasn’t initially required of U.S. Oil Sands until Western Resource Advocates filed a legal challenge on behalf of Living Rivers. The Utah Division of Oil, Gas and Mining decided a water quality monitoring program and compliance with federal air quality regulations were necessary as conditions for approving the company’s expansion request.

Vernal attorney Gayle McKeachnie is representing Bert and Christine DeLambert, who own property near the U.S. Oil Sands project. The couple suspect the mine perched above their property in Main Canyon is the cause for one of their springs going dry, and another flowing at 10 percent of what it used to be, McKeachnie said.

“They’ve had lush meadows, fishing ponds, irrigated fields,” McKeachnie said. “It’s now barren land; fish have died.”

The DeLamberts had been selling some of their water to other oil and gas interests. However, the springs didn’t stop running until U.S. Oil Sands started mining above their ranch, McKeachnie said.

“Mr. DeLambert is hurting – it’s been a great economic loss for him but he has not been able to prove a connection,” McKeachnie said.

Former Grand County Council member Lynn Jackson, who worked as a geologist for 32 years with the Bureau of Land Management (BLM), said he’s not convinced that water is an issue at the oil sands project.

“We’ve been in a dry period,” he said. “I have springs on my property that are less than they were 25 years ago. Springs in general, in the area, have decreased. It’s difficult to tell if it’s a result of natural drought periods or from mining.”

Todd said that the project “employs a fair amount of water,” but added that 95 percent of the water used is recycled. Beyond those comments, though, he declined to elaborate on water issues, calling it “old news” and “not of interest to me.”

The U.S. Bureau of Reclamation office in Provo, along with the Utah State Engineer’s Office, has requested that U.S. Oil Sands apply for a federal water contract because the company seeks to appropriate water from a segregated portion of the Flaming Gorge reservoir.

Weisheit said he would welcome a federal water contract because it would give the public an opportunity to comment, and would require consultation with Native American tribes, as well as with the U.S. Fish and Wildlife Service.

Todd wouldn’t say when he expects the project to become profitable. He said shareholders prohibit that kind of speculation.

Jackson said the market should decide whether the project continues.

“I’m in favor of letting the project proceed,” the former county council member said. “If the market is not supporting it, it will go away. If it’s a viable product that we all use, I’m for it.”

Michael Hogue, a senior research statistician with the Kem C. Gardner Policy Institute at the University of Utah, worked with a team that evaluated the break-even price of oil for a generic ex-situ (surface) oil sands operation in the vicinity of the U.S. Oil Sands site at Asphalt Ridge in Vernal.

“That study found that the break-even price of oil for such an operation is between $77 and $124 dollars per barrel, depending on the rate of return an investor would expect based on a project with this risk profile. The current price of oil is around $43 per barrel,” Hogue wrote in an email to the Moab Sun News.

Company borrows $5 million to keep PR Spring project going

If the market is not supporting it, it will go away. If it’s a viable product that we all use, I’m for it.