Some information may be outdated.

Starting next year, the average owner of a $200,000 home can expect to pay an extra 68 cents per month to help fund upgrades to county-maintained cemeteries.

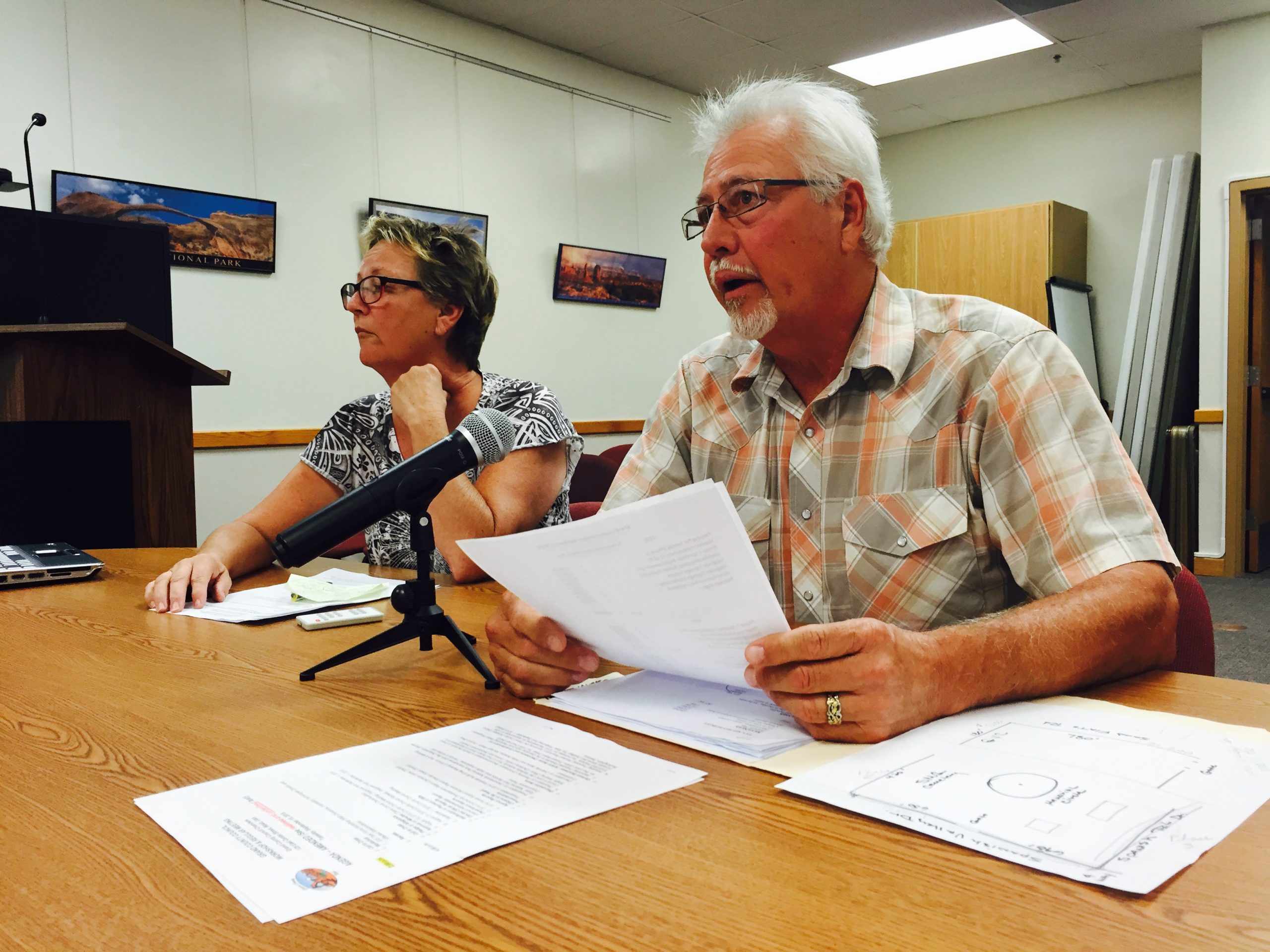

The Grand County Council voted 5-1 on Tuesday, Sept. 15, to approve a resolution that increases the Grand County Cemetery Maintenance District’s 2016 certified tax rate by 47.18 percent. Jaylyn Hawks voted against Ken Ballantyne’s motion, and Grand County Council chair Elizabeth Tubbs was absent from the meeting.

This week’s discussion marked the third time in six weeks that council members reviewed the cemetery district’s request for a property tax hike.

Initially, they asked the district to prepare a ballot question that would have allowed voters to weigh in on the proposal. When that ballot question never materialized, council members said they wanted more time to hear from their constituents.

However, just one person formally submitted written comments on the proposal, and no one from the public spoke for or against the increase at the council’s meeting on Tuesday.

Altogether, the increase is expected to raise an additional $100,000 a year.

“For such a small tax increase, this has been one of the more difficult decisions,” Grand County Council member Lynn Jackson said. “I mean, I have literally gone back and forth and back and forth.”

Down to the wire, Jackson said he was planning to vote against the proposed resolution.

“I came tonight prepared to say, ‘Take it to the voters,’ he said.

But ultimately, he said, Grand County Cemetery Maintenance District Manager and Sexton Robert Buckingham made a compelling argument that the tax will help fund direly needed improvements at local cemeteries.

“This benefits Moab people,” he said. “You know, so many of our taxes are for tourism. (This) speaks to honoring the heritage of the people in this community.”

Like Jackson, Grand County Council member Rory Paxman said he wanted to send the proposal on to voters as a ballot question. Barring that, he said he wanted to tap into the county’s general fund to pay for cemetery improvements.

“I’ve been having a hard time with this,” he said. “I’ve asked a lot of people around town, and it’s gone both ways.”

Although Paxman ultimately joined the majority, Hawks said she still feels “so uncomfortable” about the idea of increasing the district’s budget by one third.

“But you’re breaking my heart – I want you to know that,” she said.

Tubbs previously questioned why the district would need an extra $100,000 in perpetuity, and along similar lines, Hawks had mixed feelings about the higher number.

“I guess part of me was hoping you’d come back with a smaller figure, because I just have a really hard time with that,” Hawks said. “And I think of other organizations, and if they were given the opportunity to spend $100,000 a year, they could probably do it. But you have been deprived for so long.”

Buckingham said the extra funding will help the district maintain or upgrade its fencing, vehicles, plumbing, sprinkler systems and roads, among other things.

Until this week’s vote, the cemetery district had not increased its certified tax rate in 20 years, and during that time, Buckingham said its operating costs continued to rise, as salaries, benefits and retirement wages went up.

According to Buckingham, $193,700 of the $287,700 budget that his predecessor submitted goes to district employees’ benefits and salaries; a retired sexton alone earns more than $11,000 a year in benefits. Operating costs and other expenses brought its most recent budget down even further, leaving it with a little more than $42,000 to make improvements at the six cemeteries it maintains.

Buckingham said that one person suggested the district could get by with the help of volunteer laborers, but he reiterated that its most pressing needs lie elsewhere.

“It’s not volunteer labor that we need,” he said. “It’s the infrastructure that we need to fix.”

Another person said the district could raise more money by increasing the prices it charges for graves.

“Well, we have,” Buckingham said. “We raised them from $100 to $500, and I think that in this community, we’re at the very top of where we can push that. And even at 10 graves a year – if I sell 10 graves – we’re talking about $5,000.”

It has also raised other service fees, he said, yet it’s still facing a backlog of maintenance work. A 960-foot stretch of new fencing alone is expected to cost more than $38,000 – almost as much as the district’s most recent budget for capital improvements.

“We’ve addressed these things that people were concerned with, but it still keeps us in a situation where we can’t play this catch-up game over the last 20 years,” he said.

Grand County Council member Mary Mullen McGann, who serves as a liaison to the cemetery district’s board, said the only person who submitted a formal comment to the council opposed the idea of a tax increase.

“It was specifically against taxes, period – not against the cemetery,” she said.

That person suggested the district could save money by xeriscaping its cemeteries – an irony that was not lost on Ballantyne, following Buckingham’s revelation that the town of Green River backfilled the Elgin cemetery with rebar and road material.

“You want xeriscaping, go look at Elgin,” Ballantyne said. “Myself, I want a big, flat piece of grass over me.”

Increase will raise an extra $100,000 per year

This benefits Moab people. You know, so many of our taxes are for tourism. (This) speaks to honoring the heritage of the people in this community.

Appreciate the coverage? Help keep local news alive.

Chip in to support the Moab Sun News.