Some information may be outdated.

Some Grand County residents are joining a statewide effort in opposition to a controversial tax reform bill passed in by the Utah State Legislature last month. The group has scheduled events throughout the area to collect petition signatures, hoping to put the issue on the 2020 ballot.

The reform bill was passed in a special session of the legislature on Dec. 12, after opposition from many corners including the state’s teachers, poverty activists and others. Republican Gov. Gary Herbert signed the measure into law on Dec. 19.

The plan lowers the state income tax rate while increasing taxes paid on groceries, gas and some services. The gas tax is expected to add at least 10 cents per gallon at the pump, legislative projections show.

Estimates released by the state’s Tax Restructuring and Equalization Task Force, which recommended the plan after a lengthy public comment period, show potentially 78% of Utah residents would receive a reduction in income taxes under the plan.

As Utah’s population grows, the changing economic reality has altered previously reliable sources of income to support government services. A projected decline in sales tax revenue as more consumers switch from purchasing taxable goods to buying untaxed services will impact the state’s General Fund, which supports many services from Medicaid to public safety.

Gov. Herbert called the tax reform package an effort to “rebalance our tax structure to create a more stable system to support our state and its citizens in the future,” in a statement on his website.

However, disparate state and local groups have united in opposition to the restructuring bill.

The bill was not able to meet a two-thirds majority when passed by the Utah State Senate, which leaves the bill be subject to a citizen referendum to allow voters to decide the issue.

Under current Utah law, supporters of the referendum must collect 115,000 signatures by Jan. 21 in order to place the issue on the 2020 ballot for voters to approve or reject.

In Grand County, a group of teachers and community members organized protests outside local schools before the special session to raise the alarm to the potential consequences for the state’s educational system.

A substantial portion of Utah’s education funds come directly from income tax revenue so without a plan to replace the money lost, the reform package’s changes would cut the amount of funding available for public education, particularly in rural counties.

“A number of us Moabites are fired up and gathering registered voters’ signatures on the Utah 2019 Tax Referendum in town here, Castle Valley, and in points beyond,” said Ryan Anderson, formerly a Grand County High School teacher and now vice president of Utah Education Association-Retired. Anderson opposed the bill on behalf of the state’s teachers and is now part of the group collecting petition signatures.

Recent changes in the state’s laws governing citizen referendums mean that signatures must be collected from all regions in the state, placing a new importance on local organizing. The petition must gain the support of a minimum of 8% of registered voters in 15 of the state’s 29 counties.

“We need to gather over 629 signatures in Grand,” said Anderson.

Both the Grand County Republican and Democratic parties are among the groups opposing the new tax law.

The Grand County Republican Party released a statement in support of the tax referendum effort, stating that “the increased taxes on food are simply unacceptable,” and that they believe the increased fuel tax will impact rural Utah residents “who have to drive further for everything.”

“While we appreciate the hard work our legislators engaged in to reform the base tax structure, they did a poor job with this effort, with the only positive coming in the form of income tax reduction,” the statement said.

Almost two-thirds of Utah residents are opposed to the tax reform bill, according to a poll by UtahPolicy.com. Grand County citizens organizing around the petition drive say that they can see that the bill is clearly unpopular by how many people are signing on early.

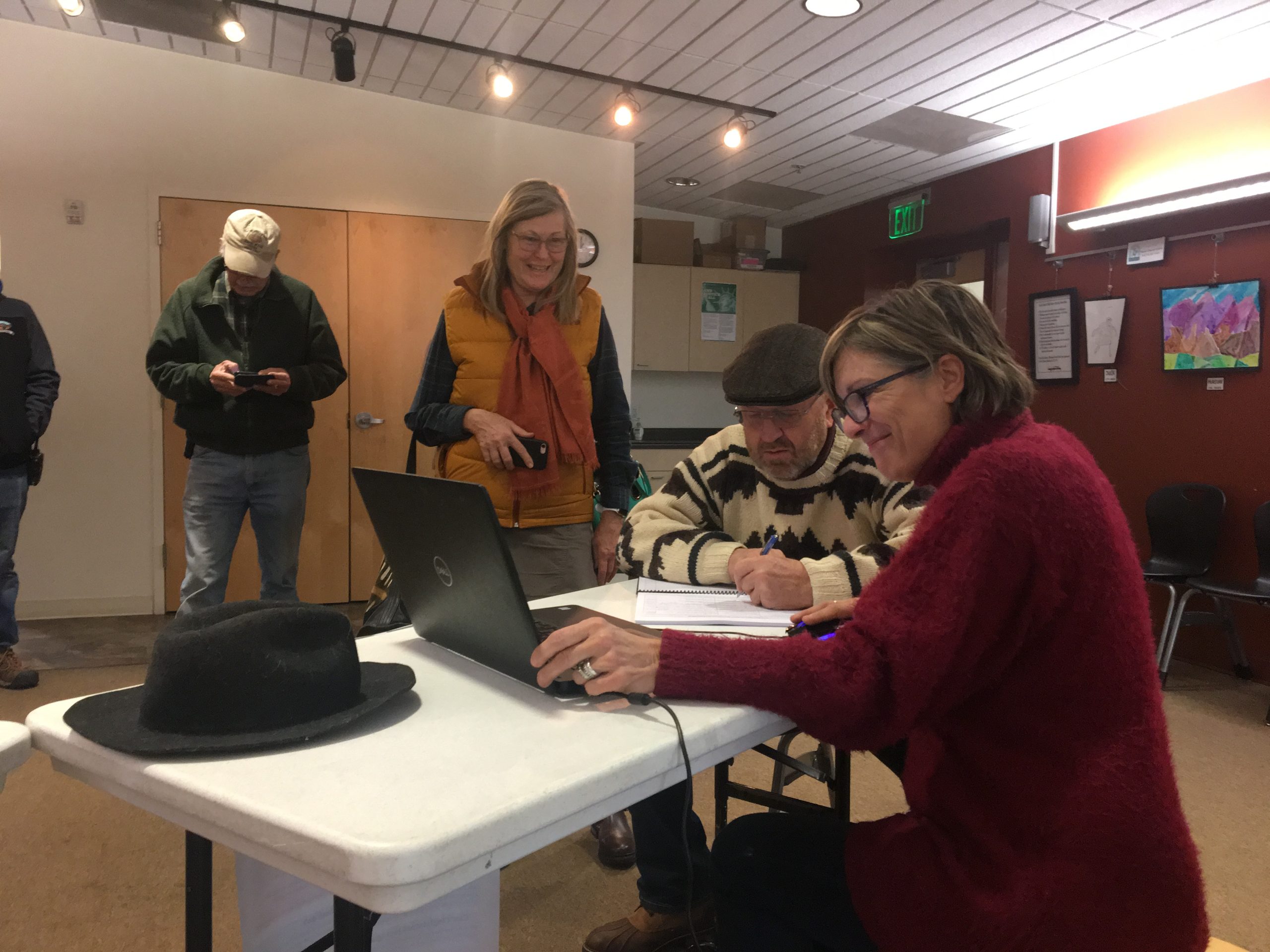

“We already have to get more signature sheets,” said Anderson at a petition event on Dec. 31, gesturing to binders of completed forms.

“All kinds of people are getting involved in this,” said Anderson, “there’s a lot of diversity in people’s opinions and politics, but everyone is clear that this bill shouldn’t have been passed the way it was.”

The group is collecting signatures leading up to the late January deadline, including on Friday, Jan. 3, from 3 to 6 p.m. at the Grand County Public Library. Petition signature events across the state are listed online at www.ut2019taxreferendum.com.

Both State Rep. Carl Albrecht and Sen. David Hinkins, representing Moab and surrounding areas, voted yes on the plan.

In a conversation with the Moab Sun News prior to the bill passing, Albrecht said that while he had initial concerns about the bill it had gained his approval.

“It isn’t perfect, but it’s good enough,” he said, “and no matter how you slice and dice it, this is a substantial tax cut for people in Utah.”

Candidates for Utah’s governor post weighed in on the controversial reform package as well.

Gov. Herbert has announced he will not seek reelection and formally endorsed his Lieutenant Gov. Spencer Cox. Cox has declined to support the referendum effort, as his office oversees elections. However, while the bill was being debated he issued a statement saying that he felt the bill was rushed and opposed passing it in the special session of the Legislature.

“While the Legislature is to be commended for traveling the state and listening over the past six months,” said Cox’s statement, “that is different than taking a proposal that was finished four days ago and working to help the public understand and support such significant changes.”

Candidate Jon Huntsman Jr.has publicly opposed the plan’s tax on groceries. The former governor had opposed placing a sales tax on food entirely as part of a tax reform package he worked on in 2006.

Candidates Aimee Winder Newton, Jeff Burningham and Zachary Moses have also joined the referendum effort, adding their signatures to the petition at a press conference on Dec. 23, as reported by the Deseret News.

The full bill and reports can be seen by going online at www.le.utah.gov and searching for the Tax Restructuring and Equalization Task Force.

Residents begin collecting signatures in Grand County

Appreciate the coverage? Help keep local news alive.

Chip in to support the Moab Sun News.