Some information may be outdated.

Today Utah Governor Gary Herbert said evictions will be halted in the state for the month of April by executive order.

At a April 1 press briefing, the Governor said that tenants impacted by COVID-19 may defer rent payments until May 15; landlords may not initiate eviction proceedings until that date.

The news is likely to be welcome to many in Moab, where the cost of living is above average and a significant portion of residents are out of work due to the impact of COVID-19 on the tourism industry.

In a state report released in 2018, almost a quarter of Grand County households were classified as “Severely Cost-Burdened,” where more than 50% of the household income went towards housing costs. The study also identified Grand as a county in which rent costs were rising while the average income was decreasing.

“This does not get rid of the obligation, but it creates time and space for other measures to come online,” Herbert commented. Federal stimulus funds from the CARES Act, intended to ease the economic burden on individuals put out of work or on reduced hours due to the COVID-19 pandemic, are not predicted to get into the public’s hands for weeks.

“I am so grateful to our financial institutions and our landlords who are working with homeowners and tenants to help ease burdens. We recognize and salute your forbearance,” Herbert said at the press briefing.

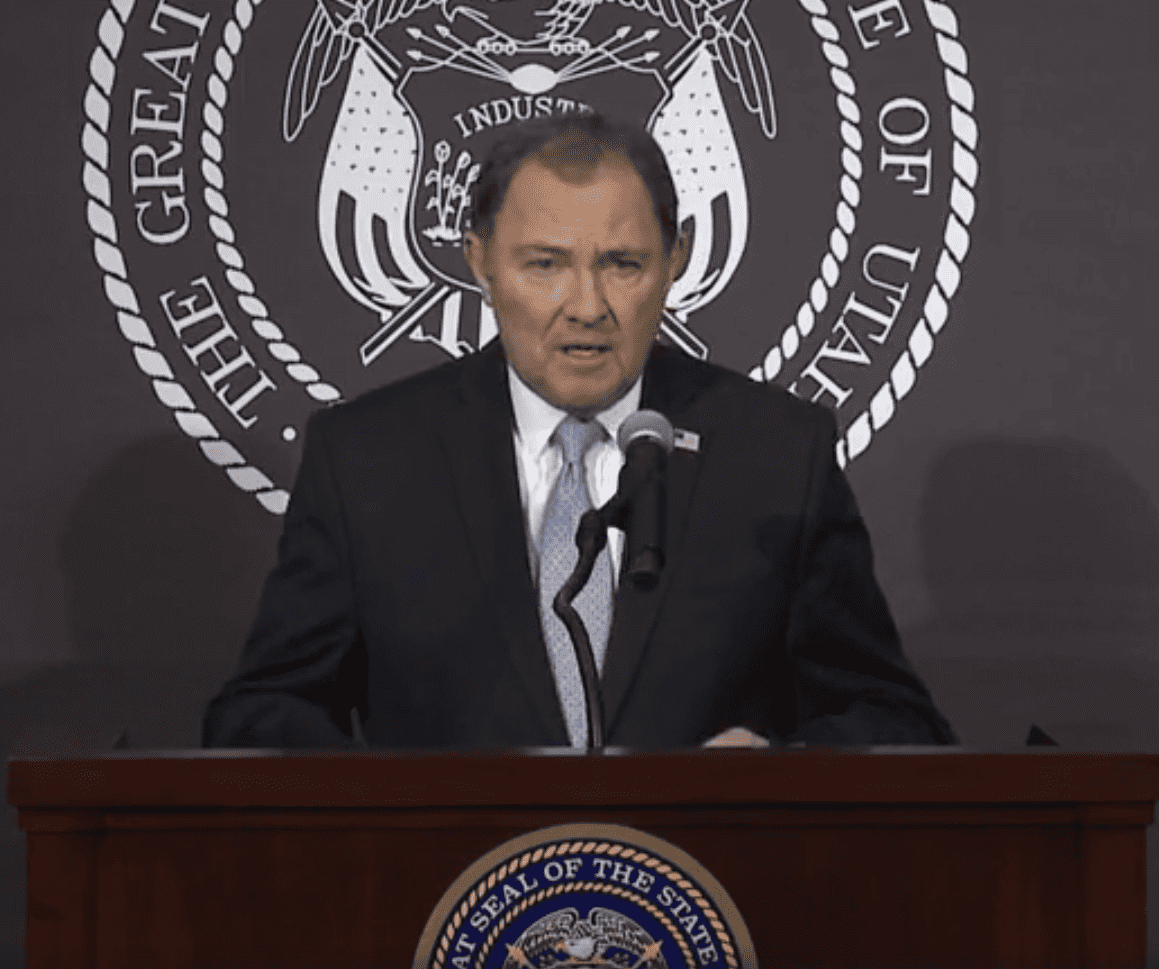

Governor Gary Herbert speaks at a press briefing. [Video still]

In a post on his official Twitter page, the Governor commented that “I will issue an Executive Order allowing tenants to defer rental payments, and freezing evictions until May 15. We are working with the federal government to secure additional relief for Utah residents.”

The Utah Housing Coalition praised the announcement. The group had been calling for a statewide moratorium on evictions and foreclosures since March 17.

“We believe housing stability is crucial in a public health emergency in which containment and treatment rely on individuals staying indoors and not being forced to seek shelter or experience homelessness,” a statement from the group’s said.

The group has a resource guide for those out of work or on reduced hours due to the outbreak.

For homeowners, many banks have been announcing deferment or suspension of mortgage payments during the crisis. Bank of America suspended foreclosures for at least 90 days. Wells Fargo has suspended residential property foreclosures sales and evictions indefinitely.

The Trump administration has also ordered a foreclosure moratorium on single-family home mortgages administered by the Federal Housing Administration or obtained through government-owned lenders Fannie Mae and Freddie Mac.

The federal CARES Act also includes language barring eviction or late fees on properties receiving any federal aid. Those owing money to Fannie Mae or Freddie Mac must request forbearance but will be granted up to six months of deferred payments.

This is a developing story and this page will be updated as information comes in

The Moab Sun News needs your support. Become a member today and receive a digital edition emailed directly to you each week. Show your support for independent community journalism and subscribe to our e-editions.

Appreciate the coverage? Help keep local news alive.

Chip in to support the Moab Sun News.