Some information may be outdated.

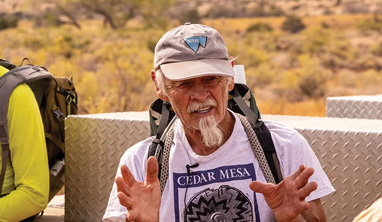

As local businesses began reducing hours or closing entirely in response to the COVID-19 pandemic, Joe Kingsley realized that many of his tenants would be short on wages or out of work completely. Kingsley is the owner and president of DMA International, Inc., a property management company with 11 accounts, a mix of rentals and mortgages.

“Looking over my account list, almost all of them are in the service or tourist industry and are being negatively hit,” Kingsley said of his tenants. “So I thought the best thing for me to do is join the pain.”

Kingsley announced that he will “stop the clock” on all rentals and mortgage payments for as long as the Southeast Utah Health Department’s current closure order is in place.

“Four of my renters actually called me and cried, they were so grateful,” Kingsley said. “Just that made it all worthwhile to me, because it feels like we’re family.”

Kingsley said he can afford to defer the payments for one month. By then, he hopes the restrictive order will be lifted and the economy will start picking back up.

Housing security in the time of COVID-19

On March 17, Southeast Utah Health Department Director Bradon Bradford announced the mandatory closure of restaurant dining rooms, bars and overnight lodging for Emery, Carbon and Grand Counties. The restrictions reflect similar orders and shut-downs across the country and the world in response to the COVID-19 pandemic.

Reduced economic activity means reduced wages for workers, and workers in service industries are taking a particularly hard hit.

Agencies at the federal level and across state and local jurisdictions have been busy crafting rent assistance plans to help stabilize housing during this public health crisis and the predicted economic downturn.

“We believe housing stability is crucial in a public health emergency,” reads a March 16 press release from the Utah Housing Coalition. “Recent significant reductions in working hours, wages, or travel restrictions pose a hardship to Utahns who already struggle to make rent or mortgage payments.”

The organization has asked the Utah Governor’s Office and the Utah COVID-19 Task Force to “explore state-wide moratorium on evictions and residential foreclosures” and to “seriously consider providing financial assistance to Utahns who cannot pay their rents or mortgages due to loss of jobs or reduction in working hours.”

Twelve states and fifteen cities so far have enacted some form of rent assistance program, according to the National Low Income Housing Coalition. In Grand County, some housing assistance programs are administered by the Housing Authority of Southeastern Utah (HASU). Ben Riley is the executive director of the HASU, and is working with the local COVID-19 Task Force to create a brochure compiling information and resources on homelessness, mortgage and rent deferral programs, and landlord/tenant obligations. Currently, the parameters of some of HASU’s existing programs allow the agency to flex payments in response to circumstances.

“Many of our programs directly relate families’ income to their rent payments,” explained Riley. “As their incomes fluctuate so does their rent, possibly going down to $0 with us helping pay for a portion of their utility costs.”

As of press time, the Utah Housing Coalition has not heard back from Utah leaders regarding their request.

Fed takes steps

The Federal Housing Finance Agency announced on March 17 that housing lending giants Fannie Mae and Freddie Mac (“the Enterprises”) will suspend foreclosures and evictions across the nation for at least 60 days. The suspension applies to homeowners with an Enterprise-backed single-family mortgage.

On March 23, the Federal Housing Finance Agency went a step further, announcing that the Enterprises will offer multifamily property owners mortgage forbearance if they agree to suspend evictions for renters unable to pay their rent because of impacts from the pandemic, along with other measures the agency says will support the mortgage market.

The Department of Housing and Urban Development authorized a moratorium on foreclosures and evictions for single-family homeowners with Federal Housing Administration-insured mortgages for 60 days, starting on March 18.

The National Low Income Housing Coalition is a national nonprofit dedicated to securing decent homes for low-income earners in the United States. They are asking federal policymakers to take action on housing during the COVID-19 pandemic.

“The NLIHC-led Disaster Housing Recovery Coalition is pushing for a broad array of resources and protections,” says a statement on the NLIHC website. The organization lists emergency rental assistance and eviction prevention assistance, a national moratorium on evictions and foreclosures, and emergency funds for homelessness service providers, housing authorities, and housing providers as some of their recommendations.

Meanwhile, national leaders in Congress and the White House have been crafting a monumental national stimulus package to help all levels of the economy through the economic slow-down caused by the pandemic. At press time, the latest negotiated version of the bill had not been voted on, but is expected to pass. It earmarks $2 trillion in aid. Some money will be distributed directly to American adults, which may help ease rent and bill payments. The spending package also has provisions for unemployment, the health care system, state and local governments, and businesses.

Efforts from state and private sector

Though the Utah State government has not enacted housing assistance programs specifically in response to the pandemic, non-governmental organizations have issued statements and implemented policies that could give relief to struggling workers.

Aside from the Utah Housing Coalition’s request to state leaders for rent deferment programs, the Utah Apartment Association and the Utah Bankers Association have announced policies intended to ease the pain of the economic slow-down for renters and homeowners.

The Utah Apartment Association is promoting rent deferment plans for the month of April 2020. Renters can qualify for these plans if they can prove that their financial status has been directly impacted by the virus because of infection, quarantine, lost hours or wages. Plans may allow April rent to be paid in installments.

“The industry also intends to temporarily stay eviction proceedings for renters that qualify,” the press release says, going on to ask that renters who are able to keep up with their normal payments should continue to do so.

For property owners and landlords who would like to provide rent relief for their tenants, the Utah Housing Coalition has made available a blank generic residential lease addendum form to simplify assistance agreements. The form can be found on the Utah Housing Coalition website, utahhousing.org.

The Utah Bankers Association issued a press release on March 18 assuring the public that Utah banks are prepared for emergencies like the current pandemic and that there are programs available to help those impacted by the pandemic.

“Assistance such as deferred payments, loan modifications and fee abatements are available, and we are preparing to facilitate low and no interest federal disaster loans,” the press release reads.

The Utah Bankers Association also cautions the public to be cautious of potential scammers who see widespread anxiety as an opportunity for exploitation.

Private businesses have also announced efforts to help workers. According to HousingWire, a real estate magazine, the Bank of America said their customers can request “to defer their payments while the virus crisis rages.” If their request is granted, the deferred payments would be added to the end of the customer’s loan.

Private utility companies have also announced special measures during the pandemic: Dominion Energy, which provides natural gas to Utah customers, said they will not shut off service to customers due to nonpayment during the pandemic. Emery Telcom, which provides internet service to Utahns, offered free internet through the end of the school year to families with school-age children who are continuing their education from home through online learning.

Stay strong

In Moab, Kingsley said it’s important for the community to support each other and remember that everyone is feeling the economic impact of restrictions crucial to slow the spread of the virus. He commended local leaders, in particular County Administrator Chris Baird, for their response to the pandemic.

“To make this decision to quarantine Moab was a very tough decision,” Kingsley said of Baird and other community leaders, “but it’s going to save lives.”

He also commended the community as a whole and encouraged everyone to hang in there.

“I am impressed how well the community has pulled together in this,” Kingsley said. “Moab needs to stay together as a community. Be strong.”

In this time of crisis, the Moab Sun News needs your support. Become a member today and receive a digital edition emailed directly to you each week. Every dollar supports our work. Show your support for independent community journalism and subscribe to our e-editions.

Appreciate the coverage? Help keep local news alive.

Chip in to support the Moab Sun News.