Some information may be outdated.

Update 1/23: Gov. Gary R. Herbert and Republican lawmakers issued a statement today announcing that they will seek to repeal the SB 2001, a controversial tax restructuring bill, rather than allow the bill to go to a voter referendum in November.

“Once the repeal is signed into law, the legislature will begin work under the reinstated tax code to prepare the fiscal year 2021 state budget. Repealing S.B. 2001 will enable the legislature to draft the budget without the uncertainty of a referendum potentially changing the tax code midway through the budget year,” the statement read in part.

Signatures from residents in support of a statewide tax referendum have been submitted to authorities, and preliminary numbers indicate the effort collected far more than the minimum required by the state.

The group organizing the petition drive in Grand County reported that over 970 people signed onto the effort to place a Utah state tax reform bill that proved deeply unpopular across the political spectrum on the 2020 ballot.

Final numbers from Grand County are likely to change due to signatures from residents of other counties, but still look to surpass the number of signatures required to support the referendum.

“I have two kids, one in school,” said Cassie Patterson, a Moab resident who joined the referendum effort. “I work at a school and I’m a single parent. This tax bill would affect me and the people I know…I couldn’t stay quiet about that.”

The tax reform bill at issue was passed in a special session of the legislature on Dec. 12, after opposition from groups including the state’s teachers, poverty activists, rural residents and others. Republican Gov. Gary Herbert signed the measure into law on Dec. 19. The plan lowers the state income tax rate while increasing taxes paid on groceries, gas and some services.

Before the bill was passed, a group of teachers and community members organized protests outside local schools to raise the alarm about the potential consequences of cutting the state’s income tax. A substantial portion of Utah’s education funds come directly from income tax revenue, so the reform package’s changes would cut the amount of funding available for public education, particularly in rural counties.

Recent changes in the state’s laws governing citizen referendums mean that signatures must be collected from all regions in the state, placing new importance on local organizing. Referendum petitions must gain the support of a minimum of 8% of registered voters in 15 of the state’s 29 counties.

“We did it here and we did in a number of counties around the state, said Ryan Anderson, one of the organizers of the Grand County effort.

Anderson, formerly a Grand County High School teacher and now vice president of the Utah Education Association-Retired, opposed the bill on behalf of the state’s teachers.

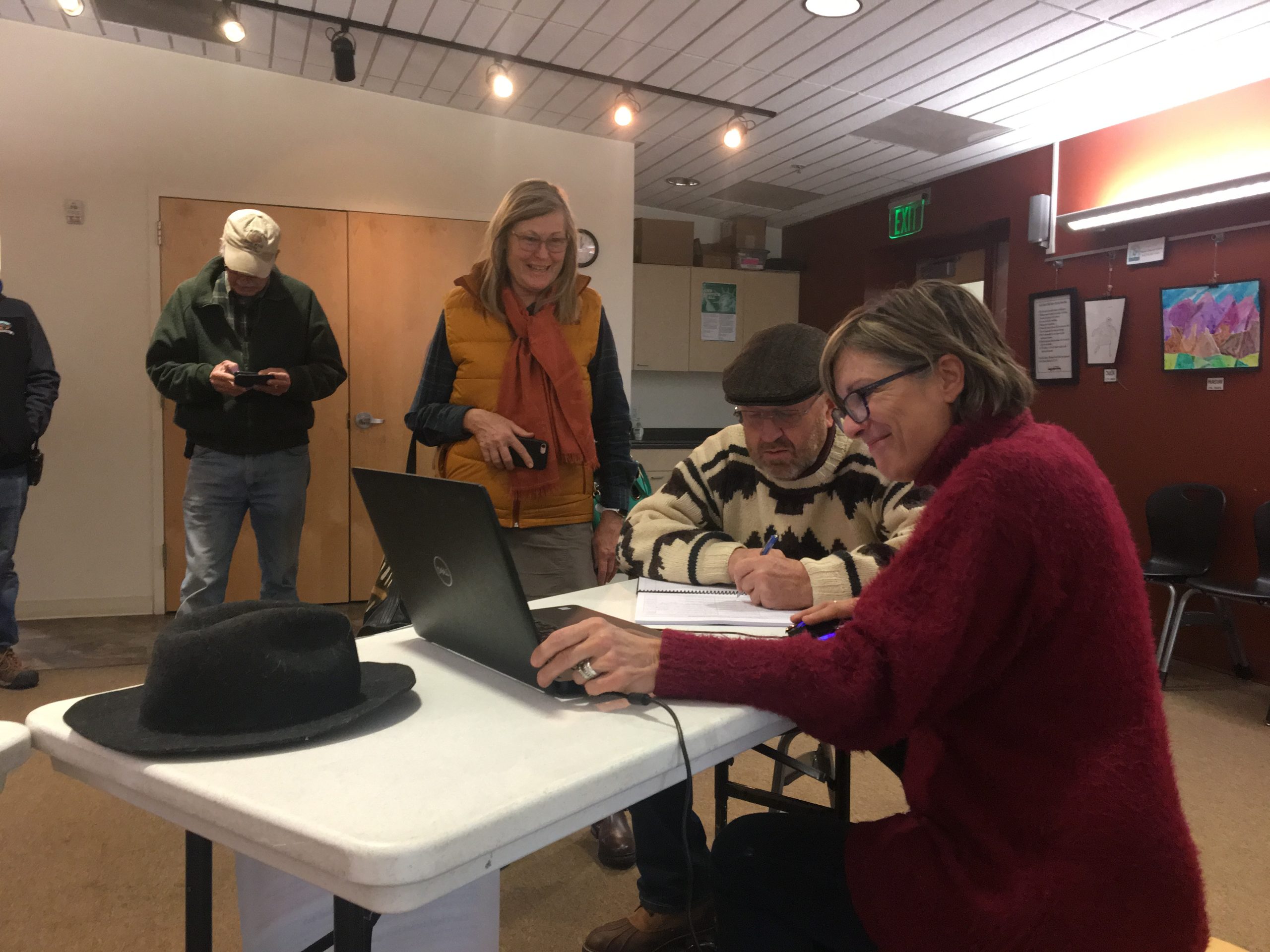

“The organizational team here was amazing and the way that the word spread through social media and community connections…It was truly a statewide grassroots effort,” Anderson said. The group collected signatures at events at the Grand County Public Library throughout January.

“With the upcoming legislative session, this will hopefully open the way for serious and inclusive dialogue,” Anderson said, adding that he plans to attend the Salt Lake City sessions in person.

Final statewide numbers are still being tallied, but Fred Cox, the former Republican state lawmaker at the forefront of the referendum effort, told the Deseret News that 152,000 Utah residents signed the petition. 115,000 total signatures are required to place the issue on the ballot.

Both the Grand County Republican and Democratic parties are among the groups opposing the new tax law, while both State Rep. Carl Albrecht and Sen. David Hinkins, representing Moab and surrounding areas, voted “yes” on the plan.

Patterson said that she was tempted to reach out to her state representatives to question why they supported the tax restructuring bill, but has decided so far not to do so.

“I don’t think I would be able to be civil,” she said.

Still, those involved with the referendum effort appear to feel positive.

“These last few days, we’ve seen so much energy from people coming in to sign,” said Anderson, “and they were all kinds of people wanting to talk.”

Patterson agreed that the effort made an impact on her. She has “strong opinions on Facebook,” she said with a laugh, but connecting with people in the community in person was reassuring.

“It was nice to agree with so many different people on so many different parts of this issue,” said Patterson. “You don’t get that all that often.”

“Seeing all these people come out,” said Anderson, “I have to say it gave me a lot of hope in these divisive times.”

The full bill and reports can be seen by going online at www.le.utah.gov and searching for the Tax Restructuring and Equalization Task Force.

Appreciate the coverage? Help keep local news alive.

Chip in to support the Moab Sun News.