Some information may be outdated.

The Utah office of the Bureau of Land Management is in the planning stages of a statewide oil and gas lease sale in June. According to the sale’s BLM e-planning website, there are seven parcels located in the Green River and Canyon Country Districts being considered for lease.

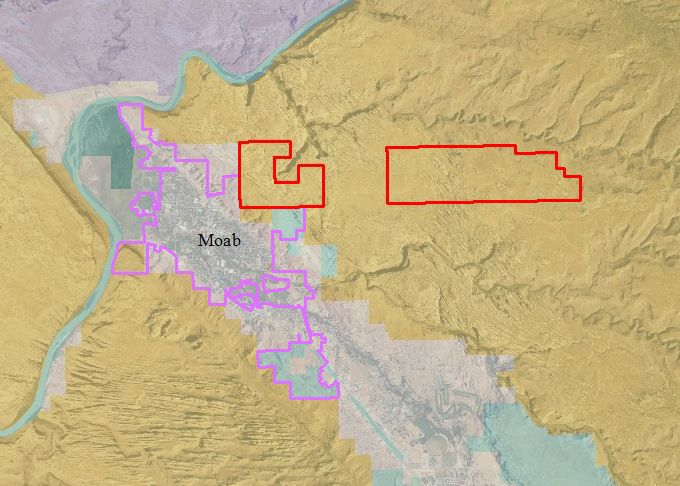

Two of those parcels are within the Sand Flats Recreation Area, a beloved recreation area just outside of Moab city limits.

Land within the Sand Flats Recreation Area is under a “No Surface Occupancy” regulation. Parcels may be leased for oil and gas development, but no development on the surface of those plots can take place. An alternative for developers might be directional drilling, in which a surface operation on a nearby parcel facilitates horizontal drilling to extract underground resources from beneath the “No-Surface Occupancy” parcels. The practicality of directional drilling to access these particular parcels is unclear.

“The parcels are currently under review,” said Rachel Wootten, Public Affairs Specialist for the BLM.

Sand Flats Recreation Area Director Andrea Brand had no official statement on the proposed parcels, but she did say that the issue has never come up in the fifteen years that she has served as director.

“This was a new thing,” she said of the nominations inside the recreation area.

Parcels may be nominated by the public to be included in competitive oil and gas lease sales. These nominations are called “expressions of interest,” or EOIs. Expressions of Interest for the June sale were open between Sept. 4 and Dec. 2 of 2019.

“Submitting an EOI to the BLM does not guarantee that parcels will be offered at auction,” according to the BLM Expressions Of Interest website.

Landon Newell, the oil and gas specialist for the Southern Utah Wilderness Alliance, gave some context to the Expressions of Interest process.

In the past, he said, the BLM’s practice was to examine the suitability of these nominations before they were added to a lease sale. If local and state officials determined that the parcels were better used as wildlife habitat, recreation areas, watershed protection areas, or some other use within the agency’s mission, they would remove them from consideration.

However, in March of 2017, the president signed Executive Order 13783, which has become known as the “energy dominance” policy. The policy directs all relevant federal agencies, including the BLM, to remove regulatory and procedural obstacles to energy development.

“The leases that are nominated, under new policy and guidance that’s been issued, are almost certainly offered,” Newell observed, but then tempered that with an acknowledgment of the “almost” in his statement.

“There’s no guarantee that [nominated parcels will] be contained in the analysis that comes up,” Newell said, “and even if they are in that analysis, the BLM does still, by law, have the discretion to defer those leases from the sale, even though it has initially considered them in its draft analysis. So there’s still quite a few steps to go here.”

The analysis Newell referenced is the Environmental Assessment that the BLM will complete for all parcels that the agency has decided to include in the lease sale. That assessment will study the potential impacts of offering each included parcel for lease. Once the draft assessment is complete, a thirty-day public comment period will follow. The public comment period for the June Utah oil and gas lease sale is not yet scheduled, but the e-planning website says it will start sometime around Feb. 20.

Parcels that may be nominated in the BLM Canyon Country District, which encompasses the Moab area, are outlined by the BLM’s Master Leasing Plan of 2016 and the BLM Moab Resource Management Plan of 2008. These documents specify what areas could potentially be leased, which may be leased with stipulations, and which will never be offered for lease. It’s these plans that identify Sand Flats as a “No Surface Occupancy” area.

If a parcel is still included in the lease sale offering after public comments are considered, and the leases are purchased, there is still another step before any development can take place on the parcels.

“Prior to approving an application for lease development, hydrologic and engineering reviews would be conducted for all proposed activity,” said Wootton. “All appropriate regulatory and mitigation measures would be included in any site-specific analysis for future proposals.”

Another public comment period could also be part of those reviews.

BLM leases are offered as ten-year terms. A developer has that long to develop the lease; if they don’t do so within the decade, the lease expires. Newell said sometimes no action occurs on a parcel that’s been leased.

“In the current market, with prices being low, we’re not seeing a lot of development,” Newell said. “But the problem is, the leasing opens the door to development… markets can change over time, and in ten years it’s very conceivable that prices are higher and there’s more demand, and so the leases could be moved forward.”

“Revenues from onshore oil and gas production on federal lands directly fund the U.S. Treasury and state budgets, and support public education, infrastructure improvements, and other state-determined priorities,” Wootton said. 48% of the revenue from the lease sale itself goes to the state in which the parcels are located and the remainder is directed to the U.S. Treasury. There is also a 12.66% production royalty placed on any profitable production on a leased parcel, of which the state and federal governments each receive half.

To learn more about the June 2020 Utah BLM oil and gas lease, visit: www.tinyurl.com/s2u29ta.

Appreciate the coverage? Help keep local news alive.

Chip in to support the Moab Sun News.