Some information may be outdated.

The deadline to enroll in health insurance coverage that will start Jan. 1 has been extended to Dec. 23. One can still enroll at any time before the March 31 deadline to avoid paying a penalty according to the Affordable Care Act. Coverage would begin a month to a month and a half after enrollment.

Grand County residents starting to explore the new Affordable Care Act’s options are discovering what the changes mean to them.

Starting Jan. 1, all insurance plans must provide everyone a comprehensive package of ten essential health benefits, cover 100-percent of preventative care, and offer unlimited annual and lifetime maximum payments.

People who have pre-existing conditions will now be able to get insurance and pay the same rates as those without pre-existing issues.

“I have type I diabetes. My health care options are $900 a month for me only, not including my husband and daughter. So we don’t have health insurance, for that reason,” said a Moab woman who wished to remain anonymous.

Using online tools to calculate an estimate of their premiums under the new system, her family can potentially buy coverage for all three of them for $500 a month.

“We’re going to be some of the people who are happy with this change,” she said.

One consideration for Grand County residents to examine, however, is their need for specialty services.

“A lot of people have to go to Grand Junction for specialty services. We have a lot of great services for a hospital this size, but were not designed to do it all,” said Jen Sadoff, director of community relations and marketing at Moab Regional Hospital.

Of the four public marketplace providers serving Grand County residents, only one has put effort into creating a network in Grand Junction.

“Arches [Health Plan] is really working towards building a network in the Grand Junction area because they know how important it is for the residents of Moab to be able to seek specialty services there,” said Renee Troutt, insurance broker with Central Utah Insurance.

She warns, however, that their network coverage in Grand Junction is still pretty thin. Services not covered in Grand Junction will usually require a trip to Provo or Salt Lake City to remain within network and thus covered by the insurance provider. Private insurances, like Blue Cross Blue Shield, now offer the broadest network across state lines.

However, buying insurance through the public marketplace is the only way to receive a tax credit or subsidy to help cover costs.

“If you fall in between 100 to 250-percent of poverty level, you fall in the sweet spot and will get the richest subsidy benefit,” Troutt said.

That translates to a family of four with an income of $23,550 to $58,875 potentially saving thousands of dollars in premium costs. Subsidies of varying degrees are available for people who make up to 400-percent of the poverty line.

“You don’t have to be on food stamps to get a subsidy. They talk about a percentage of poverty level, and you think, well I’m not really poor. If you’re actually working, you can still get a subsidy,” said Greg Child, a self-employed Castle Valley resident.

With the subsidy they’ll receive, Child and his family of three will pay about only a quarter of what they had been previously spending, he estimated.

However, people who don’t qualify for subsidies come face to face with some of hard issues that still need work.

“I’ve seen people who might get employer sponsored coverage but are not able to get coverage for their families. Then, because they have the option for employer sponsored coverage, they don’t qualify for a subsidy on the marketplace, regardless of their income,” said Troutt. “If employers respond by canceling group benefits then it puts a larger burden than expected on the taxpayers.”

The costs for providing more people with better insurance coverage is reflected in the premium costs.

“The average individual health insurance policy is experiencing a 108-percent rate increase from 2013 to 2014,” Troutt said.

Those who don’t qualify for a subsidy are “going to pay full price and many are experiencing great increases [in their premiums],” said Troutt. Their only other option is to forgo insurance and pay the fine which can be up to 1-percent of their household income in 2014.

Adults who don’t qualify for subsidies because they make less than 100-percent of poverty are exempt from the fine. However, adults in this category who don’t have a disability or otherwise qualify for Medicaid are currently left without any insurance options.

This is an issue that will likely be worked out during Utah’s 2014 legislative session.

“[Utah] legislatures have been studying this issue all summer and are more prepared to make decisions about it,” said Jason Stevens, education and communications director with Utah Health Policy Project.

“I think it’ll take a couple more years to get some of the flaws fixed,” Troutt said. In the meantime, “I think people should definitely explore all of their options.”

As well, Moab Regional Hospital will continue to provide cash and other discounts for those without insurance.

“We all need to be invested in our community’s health. If I can help you to be healthier, as a community our insurance costs will go down,” Sadoff said.

Toward that end, Grand County residents can receive 59 different preventative services at Moab Regional Hospital, such as colonoscopies and mammograms for adults over 50. People with the new insurance plans can now participate in these services at no additional costs.

To further help the community, Moab Regional Hospital will continue their low-cost blood test that they run all through January.

“We’ll actually be running an extra discount. If they call to register before New Year’s, we’ll give them an extra $10 off. It’s like a $400 blood test for $50,” Sadoff said.

Grand County residents navigating marketplace insurance options

“Arches Health Plan is really working towards building a network in the Grand Junction area because they know how important it is for the residents of Moab to be able to seek specialty services there.”

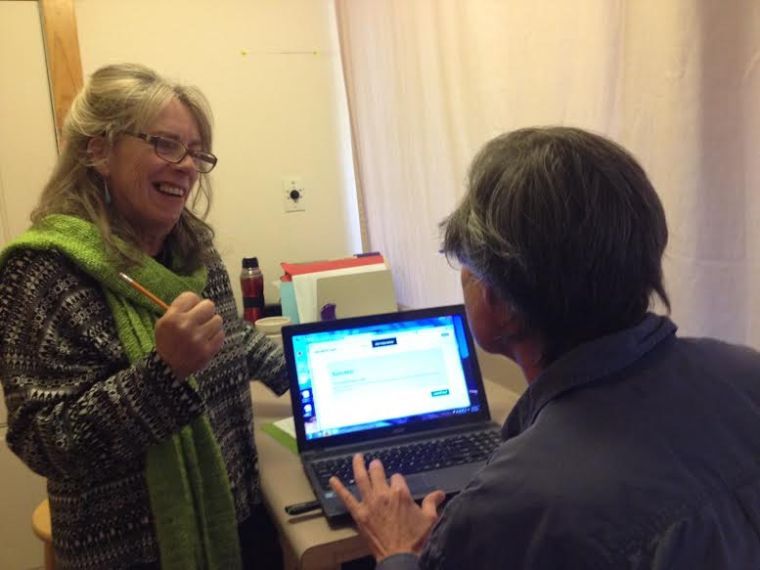

Certified application counselors are available free of charge to help people sign up for marketplace insurance at Moab Regional Hospital and the Moab Free Health Clinic.

Wednesdays at Moab Regional Hospital; call 259-7191 to make an appointment.

Thursdays at Moab Free Health Clinic; call 259-1113 for to make an appointment.

Visit www.healthcare.gov, for more preview market based plans and prices for Grand County.

You can calculate your estimated premium cost with subsidies at: http://kff.org/interactive/subsidy-calculator/

Appreciate the coverage? Help keep local news alive.

Chip in to support the Moab Sun News.