Some information may be outdated.

Moab Regional Hospital management had a decision to make in May: Pay staff or pay the mortgage. Payroll took precedence and the mortgage payment was made five days after the grace period was over for the month, said Roy Barraclough, Moab Regional Hospital CEO.

“Housing and Urban Development (HUD) chose to recognize it as a technical default and they began monitoring us very closely,” Barraclough said. HUD’s scrutiny began earlier, though, Barraclough said, when Moab Regional Hospital’s chief financial officer left the hospital in January and reports were not being done regularly.

HUD provides insurance on the hospital’s $30 million mortgage. HUD worked with the Moab Regional Hospital’s board of directors to use a mortgage reserve fund to hire Quorum Intensive Resources (QIR), a healthcare consulting firm, to help the hospital improve its systems and services.

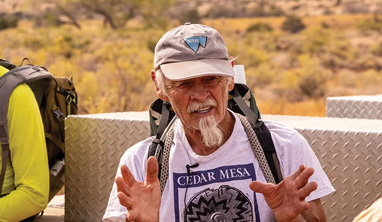

“The analysis process has begun and within a few weeks we expect to be formulating a plan for improved hospital performance,” said QIR consultant Jim Richardson. “The board and administration has already done a substantial amount of work towards putting changes in place, and we expect additional significant changes within the next few months.”

Barraclough said the problem was cashflow.

An increase of business was expected when Allen Memorial Hospital was closed and Moab Regional Hospital was opened February 2011. However, the systems were not in place to handle the even higher than expected influx.

“We knew we would have an increase in patient activity,” Barraclough said. “As a curiosity factor, people wanted to see the new facility. We didn’t think the increase would develop for the first five months. It happened in the first four weeks.”

Changes in process and procedure were not done in time, Barraclough said.

“We got behind in our billing. We got behind in our collections. And we started to suffer from a reduced cash flow,” Barraclough said. Cash reserves were depleted by May when the hospital had both a mortgage payment and payroll to meet. Billing procedures have been changed and cashflow has increased since then.

“We’re collecting our money and we’re collecting it quicker,” Barraclough said. “We’re able to start building our cash reserves to where they were before.”

The hospital also budgeted to receive Medicaid Disproportionate Share Payments (DSH), which are given to hospitals that provide care to low-income patients that do not have other payers such as Medicare, Medicaid, Children’s Health Insurance Program (CHIP) or other health insurance.

Allen Memorial Hospital, which was owned and operated by Grand County, was a participant in the program. Under the DSH program guidelines hospitals needed to be affiliated with a governmental entity. Moab Regional Hospital was no longer eligible when it moved out of the county-owned building and was established as a private, not-for-profit organization February 2011.

Allocations from DSH average between $850,000 and $900,000 a year, Barraclough said.

As the only non-government operated rural hospital in Utah, Moab Regional Hospital worked with the Utah Hospital Association to change the policy.

Earlier this month it was determined that Moab Regional Hospital can now receive DSH funds as long as the seed money was provided by and through a government entity, such as the City of Moab or Grand County.

This year’s DSH allocation would be $876,000. However, Moab Regional Hospital needs either the City of Moab or Grand County to donate $277,000 in seed money by Nov. 29 in order to receive the compensation.

Moab Regional Hospital provided $1,164,167 in charity care and had $1,724, 270 in bad debt, which is 11 percent of the overall revenue.

Barraclough feels strongly that the county should step up and provide the seed money, due to the financial losses the hospital has due to charity and bad debt.

“That indigent care would otherwise be the responsibility of the county,” Barraclough said.

Barraclough met with representatives from Grand County and the City of Moab at a joint meeting on Sept. 7.

Grand County Councilman Chris Baird expressed concern about the hospital’s request for assistance.

“I thought we were on the same page: That before the government got involved in anything we need to see the contributing factors of the insolvency. I’m disappointed to not see that information at this point,” Baird said at the joint meeting. “I do believe that we should come up with DSH funds because it is an essential component of rural hospitals.”

Appreciate the coverage? Help keep local news alive.

Chip in to support the Moab Sun News.