Some information may be outdated.

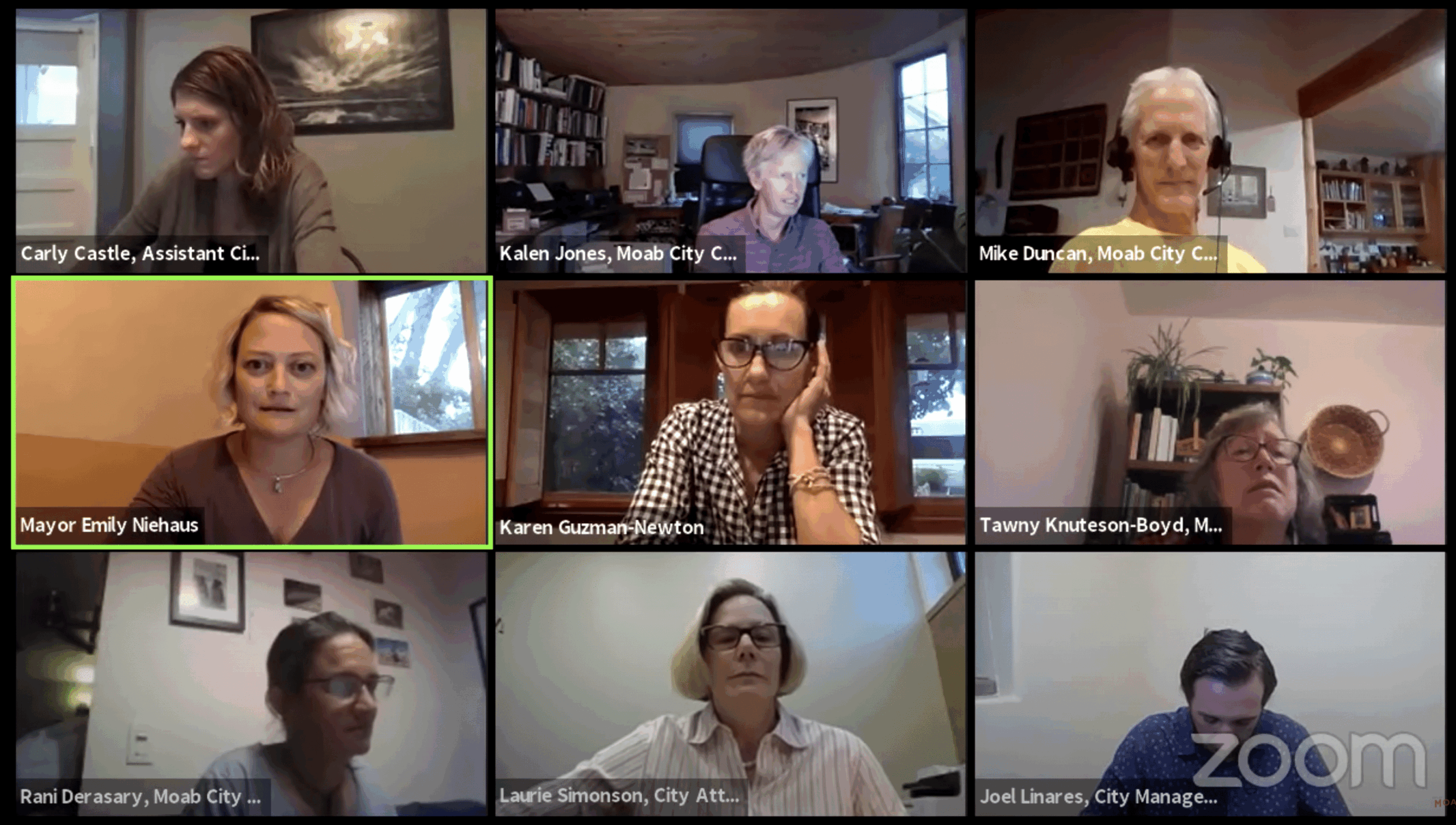

The Moab City Council held a public meeting over Zoom for residents to comment on Proposition 8 on Sept. 22. The proposed sales tax will appear on the general election ballot on Nov. 3.

Moabites spoke both for and against the proposed RAP (Recreation, Arts, and Parks) Tax, which would help fund local arts and recreation as local municipalities are already operating under a budget shortfall coming into the 2020.

As the COVID-19 pandemic has exacerbated the lack of funding for community programs, City Manager Joel Linares said that the RAP Tax would be a way for the city to secure more funding, mostly from visitors, to fund local programming and services.

The RAP Tax would add a 0.1% sales tax, or one cent for every $10 spent, on sales and uses within Moab — hotels, nightly rentals, restaurants, shops, and other businesses — to fund a broad list of recreational, cultural, arts or zoological facilities provided by the city.

“Municipalities across Utah are being urged by the State to explore alternate funding sources, and this is one that would appear to impact visitors far more than locals,” the Moab City Council said in a statement.

The tax would increase Moab’s sales tax rate from 8.75% to 8.85%, though groceries and gas would not be taxed.

The City of Moab has funded the Moab Aquatic and Fitness Center, youth sports programs, the Moab Arts and Recreation Center and other programs out of the city’s general fund, at a cost of approximately $1 million each year with the majority of the funding going towards the MRAC. The RAP Tax would lessen the financial burden on the City for providing these cultural and recreational amenities. The tax is expected to generate between $300,000 and $400,000 per year.

“It’s a good deal,” said Linares, who mentioned that City of Moab staff have been developing Proposition 8 since November of last year.

A property tax had been considered, but according to staff sales tax was chosen as it will impact Moab residents less. 2019 tax revenue documents show that the majority of all purchases in Moab — at least 79% — are made by consumers who do not live in the city, meaning that most RAP Tax revenue would come from tourist spending.

At the meeting, Mayor Emily Niehaus read a statement that will be printed on the voter information pamphlet at the polls.

“Parks, recreation, and arts are valued and cherished aspects of the daily lives of Moab citizens,” the statement reads. “Each provides opportunities for children, individuals, families and seniors to build relationships and community as well as spur creativity, health and wellbeing.”

During public comment, many Moab residents spoke of their use of public amenities and in support of the tax to support them.

“I have been an advocate of this tax as a private citizen and as an arts advocate for over 15 years,” said Theresa King. “I’m thrilled that the City Council has taken the active stance to do this.”

Cassie Paup, who lives outside of Moab city limits, highlighted how the RAP Tax would benefit local sports and culture.

“In the next ten years, we could build a legacy for arts and culture, for our parks and for our Rec department — wouldn’t that be something to look back on and be proud of?” Paup asked.

Niehaus also read eight written public statements submitted to the council. Many wrote in favor of Proposition 8, lauding the tax’s light burden on locals and potential for upgrading Moab’s recreational amenities.

“Tourists take a great deal from this community and its resources,” wrote Jenifer Evers. “There should absolutely be a cost for that & it should be paid for by those degrading it most.”

Serah Mead agreed, stating that Moab “is more than extraction (both by tourists and oil and gas industries) and development and I see this tax as a gesture of acknowledgment of that fact, along with direct action to support it.”

“It is important for us as a community to support our youth programming and city facilities,” Moab Arts and Recreation Center Director Liz Holland submitted. “I enjoy having a gym to play co-ed volleyball, taking my kids to the swimming pool, attending community events and all the amazing programs that Proposition 8 would support.”

Sara Melnicoff, the founder of local nonprofit Moab Solutions, voiced her disapproval of Proposition 8 after recent controversy about the construction of the Robin Groff Memorial Park along Mill Creek Parkway.

“I have lost all faith completely in this council’s ability to properly spend money based on the heart-wrenching and horrific desecration of the parkway against the will of many in the community,” said Melnicoff. “I will remain opposed until there’s some way for me to be assured that these funds aren’t going to be used to create more horrific damage to the land or parkway.”

Others expressed suspicions that Proposition 8 would be an additional cost to locals that might not bring about concrete change.

“Funds raised from yet another tax will benefit a very small number of Moab residents for things we will never use,” wrote Sandra Hultgren. “Too many of us are already being priced out of living here.”

“Moab needs to start handling its budget and planning process better before asking for or carelessly spending funds,” said Jennifer Wenzel.

Another community member, Marc Thomas, wrote in favor of the tax with the condition that an advisory board be established for the public to weigh in on the distribution of RAP Tax revenue.

“With input from this board and the general public at council meetings, I feel this is an effective way to help fund the city’s cultural & recreational amenities,” Thomas’s comment read.

Councilmember Tawny Knuteson-Boyd voiced her agreement with Thomas, supporting an advisory committee to “see input from the community.”

Several communities in Utah already impose a RAP tax, including Salt Lake, Weber and Summit counties as well as the towns of Blanding, Orem, Duchesne and Monticello.

Council holds public meeting on recreation, art, parks tax

Appreciate the coverage? Help keep local news alive.

Chip in to support the Moab Sun News.